Labor Day: Then and now

For a long time, Labor Day was just the last hoorah of summer. What the holiday actually meant—who knew? We just figured we worked hard and deserved a day off. But in this economic climate, it’s not just another day at the beach.

This Labor Day, we’re in the worst recession since the Great Depression. Unemployment is at 9.6%, wages are stagnant (and for many Americans, they’ve gone down), and as more employers shift to contract work, the benefits of health insurance, retirement plans, paid sick days and vacations are a fantasy of the past for many workers.

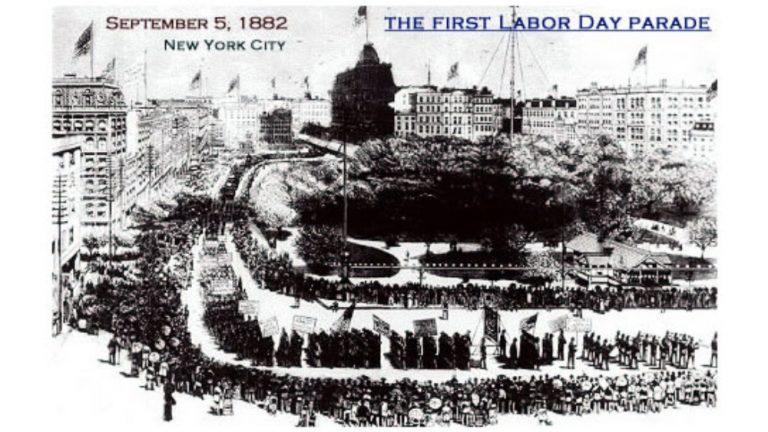

When Labor Day was first created in 1894, we were in the worst recession prior to the Great Depression, with massive unemployment and a collapse of the stock market and banks. The holiday was meant to appease workers by honoring those who have “delved and carved all the grandeur we behold.” Back then the “grandeur” referred to carpentry; it doesn’t work quite as well to describe office life, huh? But those without jobs do miss the “grandeur” of working—everything from contributing to society to the rhythmic routine of everyday life.

The economy isn’t looking up—at least not yet. So the bottom line is that you must protect yourself financially. Here are some ways to improve your situation:

Be wide open to all career options, and I mean WIDE

Research industries on the rise and see how to get training. Consider relocating to an area that offers more opportunities. Think about starting a new business. Try an adult internship that relaunches your career. Take temp, seasonal, or freelance work and find ways to extend it. Be willing to take positions you might be overqualified for—in experience and/or pay. See if taking classes or going back to school would be worth the expense. The website careeronestop.org, from the Department of Labor, has helpful resources to get you started.

Grin and bear it

Layoffs, salary freezes, and other cut-backs may make your workplace situation seem unbearable. Grin and bear it—at least until you secure a new job. Or, make the most of it by taking a class on the side, volunteering in your dream field, or just being thankful for your paycheck.

If you’re laid off, get the best severance deal you can

Expect 1-2 weeks of salary per year you’ve been at your current job) and ask if they can extend your health benefits as part of the package. (If they won’t, look for options at ehealthinsurance.com.)

Line up for unemployment…online.

As soon as you’re laid off, notify your local unemployment office. You can enroll by phone or online at your state’s Department of Labor (Google your state + Department of Labor to find the website). States calculate unemployment at about 50%-60% of your pre-layoff weekly gross pay, and every state’s maxes out at a certain level.

Prioritize, don’t panic.

You still need to make your monthly payments. This is a good time to buckle down and trim all unnecessary expenses. If you’re concerned about missing any loan payments, call your lenders immediately to let them know you’ve had a change in your financial situation. They might be willing to work with you to form a new payment plan.

And lastly, if you have specific questions about your situation, please don’t hesitate to drop me a line or leave a comment below, and I’ll be sure to get back to you.